Ever since their inception, credit cards have quickly risen to some of the most dependable aspects of human life. That???s why in today???s world, they???re being considered as the cornerstone of the American economy. It is technically impossible to find anyone who doesn???t use credit cards in the US today. And, with their vast amount of usage, there is still a lot that most users don???t understand about credit cards. One of the things that most don???t understand in regards to their credit card is the concept of credit limit.

Credit Limit

Credit limit, in essence, means the amount of credit that a financial institution offers you as their client. When it comes to credit cards, the issuer offers you credit on the credit card or on a line of credit. The limit is extended or offered based on the information you gave on your application process. The credit limit is based on your credit score.

How It Works

Whether it???s through your credit card or line of credit card, credit limit pretty much works the same. You???re allowed to spend amounts that are within your set limit. But you can overspend at some points, but it comes with penalties. Just remember that the fines you incur when you exceed your spend over your limit come on top of your annual fees. If you haven???t reached the limit of the card, you can generally continue using the card until you reach the credit limit.

Deeper Understanding

Covering the basics of credit cards was quite the easy part, now take a deeper look at what more you should know about credit limit. Your limit is generally decided by the information that you give the lender. So, what exactly do they examine before they give you a line of credit?

- Personal income

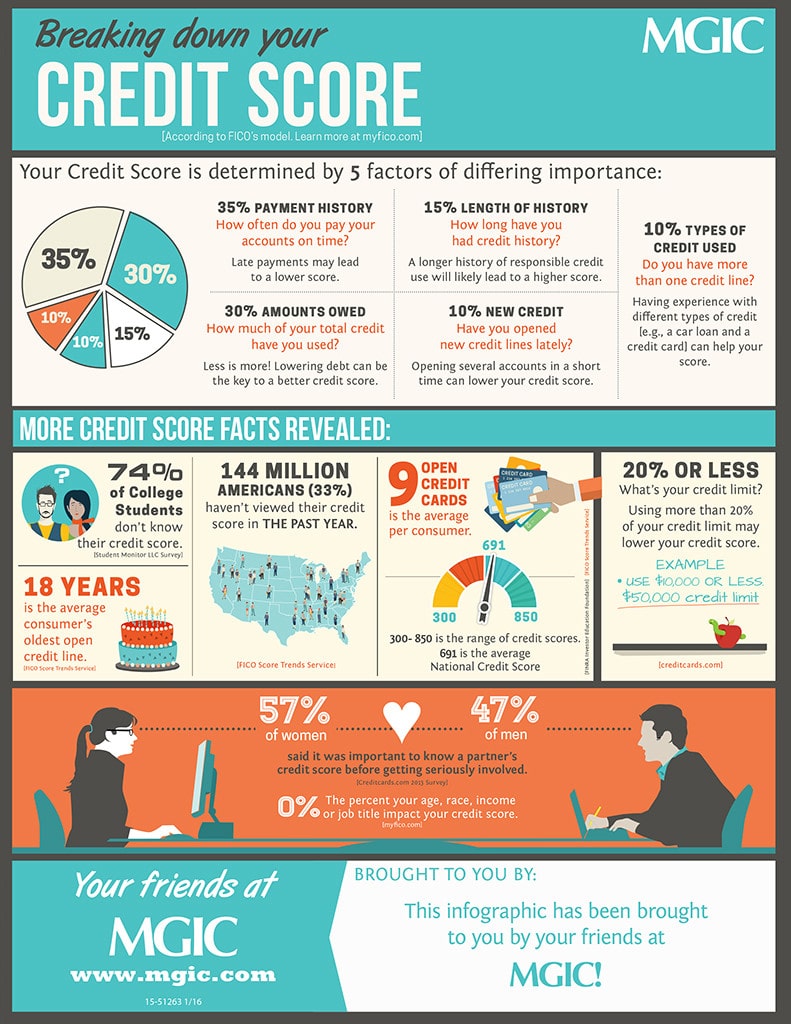

- Credit score

- Repayment history of previous loans.

These are just three of the basics, they actually check on a lot more. So, what should you not forget to put down when applying for a credit card?

- Personal financial statement

- Tax return for 2-3 years

- Only use your property as bargaining tools, don???t offer them first.

- Negotiate interest rate

- Being organized will prove that you???re less a risk than someone who comes in less prepared.

Having a high credit limit is based on the institution seeing that you???re a low-risk borrower. But watch out, it can bring about overspending.

Credit Limit Vs Available Credit

One of the most disturbing issues when it comes to credit card limit is differentiating between credit limit and available credit. Available credit is the credit you remain with after spending a portion of your credit. For example, if you have a limit of $400 and you spend $200. Your available credit is $200. That means you can only spend $200 after you spent your first $200. If you pay $100, your available credit bounces to $300. You limit remains $400 all the same.

Why is credit limit important?

Some would worry about their limit being too high because they are afraid that their debts would spiral out of control. There are others who want a higher credit limit so they won???t risk maxing out their card (they???ll worry about clearing their outstanding balance another day).

Though the above are two valid concerns when it comes to credit limits, there is one even more important reason why you should pay attention to it. Your limit is important to your finances because it can affect your credit health and credit score.

A percentage of your credit score is determined by credit utilisation, which is how much credit you???re using. Here???s how credit utilisation rate is calculated:

Most lenders consider credit utilisation rate as one of the most important factors to assess your creditworthiness.

Just as you should go on regular health screening, the same should be practised for your financial health by checking your credit score regularly.

Conclusion

In understanding your credit limit, it ensures that you don???t incur fines due to over expenditure. It???s not only about going over budget when it comes to sum of your limit; it also makes you aware of your financial state. That ensures that you can easily grow your limit over time than someone who doesn???t understand their own limit.