All credit cards are not created equal. Not all cards offer the same benefits, and they all have their own unique set of rules. You can even find a card that offers some benefits to some people, but not others. It is important to understand what the card offers, how much it costs, and how to get the most out of it. This article will help you to understand how credit cards work, what types of cards are available, and what each one offers.

A credit card is a form of financial security that allows you to make purchases using your credit card number rather than cash or a check. The credit card can be used in many ways – such as paying for groceries or gas at the store, paying your phone bill online or at the ATM machine, or making purchases on the Internet or at stores that accept credit cards (including department stores like Macy’s). The purchase amount must be paid in full by the due date of the billing cycle – typically one month after purchase. Credit cards have no fees associated with them except for some cash advance fees that may apply when you use your card at an ATM.

The primary benefit of a credit card is that it can be used to make purchases without carrying cash or writing a check. When you use your credit card, you are actually using your money to make purchases. You can even use your credit card to pay for certain types of transactions, such as using your credit card to pay for utility bills or telephone bills.

What is a Wawa Credit Card?

Wawa Corporation was officially established in April 1964. It is a United States based organization, with headquarters on the east coast of the United States. It is a chain of gas stations and convenience stores that operates in the United States. They are currently operating in maryland, virginia, new jersey, pennsylvania, delaware, florida, and washington d.c., etc.

If you are looking for a better option to pay your monthly fuel expenses at the gas pumps, then you definitely should consider applying for the Wawa credit card. Once you apply for the credit card, you will continue to receive continued fuel discounts at Wawa Gasoline. Wawa’s credit card has several savings for its customers when they use it at Wawa gas stations.

The Waawa credit card also provides some other important benefits, including the convenience of shopping at the gas pumps, the use of free online tools that help you manage your account, and many more. There are also Wawa credit card sign-ons available in many countries. In the United States, Canada, and other countries, they are readily available.

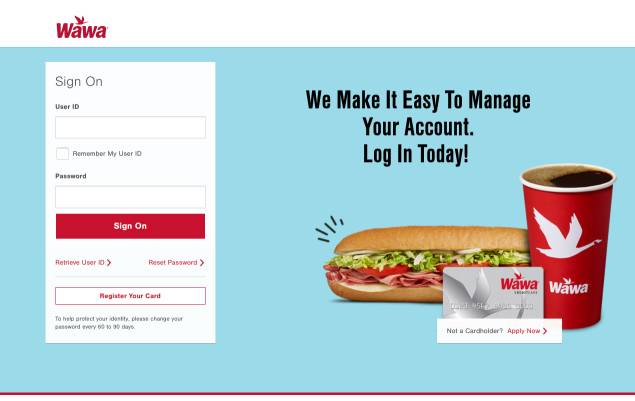

How Do I Log In or Sign On to My Wawa Credit Card?

To log in to the Wawa Credit Card and sign in, you must first have a registered account with Wawa. If you do that, make sure that you have a good internet-connected personal computer or smartphone. If you do that, you will not have any errors while logging in and going through the process below.

- First, log on to the official online portal for Waawa credit card login.

- On your browser you can also search for the word ‘Wawa Credit Card login’. Tap on the first link to get to the webpage.

- On the landing page, you must enter your user id and password in the special box, as shown on the official login webpage.

- After you tap the button that says sign in, you will be taken to your Waawa online account.

How Can I Register My Wawa Credit Card?

Before you start to register for your wawa credit card, you should be a wawa credit cardholder. If you do not have a Wawa credit card, you can still apply for one by filling out the online application form that is available on the official website of Wawa. Then, please wait at least four weeks, while your application is being processed.

If you are trying to get a card from Wawana, be sure to have it on your side while you fill out the registration form. Follow the below procedure.

- After you have registered for the Wawa Credit Card, proceed to the official Sign-On Portal for the Card. Follow the login process described above.

- While on the homepage, you can easily find the option to register your card, which you can tap on just below the sign-on button.

- After that, you will be redirected to another new webpage. Here you will fill up your wawa credit card number and press on the continue button.

- Now fill out all the required details on the next page in order to complete the registration process.

- After you verify that your user id and password have been successfully changed, you will receive an email in your inbox confirming that the changes have been made to your user id and password.

The wawa online portal recommends that you change your password every 60 to 90 days, in order that your identity is secure.

How Do I Reset or Retrieve My User ID and Password for My Wawa Credit Card?

When you wish to reset your user id and password for the wawa credit card, please read through the below guidelines.

- After logging in, you will move to the web page with the sign indicating that you are a member of the Wawa credit card network.

- On the webpage, you can find the two buttons that say “retrieve user id†and ‘reset password’, tap on them to select what you want.

- After tapping on the button that says Retrieve user id, on the next page you must enter your card number, name as it appears on the card, security code (on the card), social security number (last 4-digits) and your phone number

- After you press on the button that says verify, your information will be verified. Now you must follow the on-screen instructions to finish the transaction.

- After you tap on the reset password button, on another webpage you will be required to put down your credit card number, your name as it appears on your card, the security code (on the card), and your social security number (last 4-digits).

- Then, after you click on the button below to confirm your information, please follow the instructions on-screen to reset your password.

What Are the Benefits of Using a Credit Card From Wawa?

When you bill the first cycle of your wawa credit card, you can enjoy a credit of 50 cents per gallon of consumption at Wawa gas stations. But you must limit the usage to only 100 gallons per month. When you reach your monthly limit, the credit for water will be lowered to 5 cents per gallon.

The annual percentage rate (APR) is set at 26.49%, and it can change depending on the market rate. All credit card holders must make the full payment of their outstanding balance by or before the due date for that month. During that month, Wawa will not charge you any kind of interest. Wawa also charges late payment penalties, and the fee is up to $40.

If you have found a spelling error, please, notify us by selecting that text and pressing Ctrl+Enter.